We all know saving is important, but often we find ourselves save too little And give excuses like "I might need the cash in the future", "better keep some liquididy or myself" It is seldom we truly need our saving and it ends up that our money are sitting inside our bank account with miserable interest rate whole also suffer the corrosion by inflation.

Today, I shall talk about some ways we can save up more efficiently so that your capital or money can work harder for you.

Tuesday, November 2, 2010

Wednesday, January 6, 2010

The keys to personal financial success !

Key number 1 - Be Debt Free !

While our grandparent’s time advocate saving is a virtue, our modern day philosophy is live for today and pay in the future. We only live once isn’t it ? Spent it since we wouldn’t know what would happen tomorrow.

As more and more people grew to believe the later to be true, we have inevitably made ourselves more vulnerable to become debt burdened.

I believe the highest interest rate for loan currently being charged the loan from credit card, where 24% p.a will be charged if card holder spent beyond his credit limit.

That is 2400 for every 10K spent beyond the credit limit. Is this amount spent necessary ?

Why not we prevent all this in the first place by spending within our limit ?

May be you blamed it to the temptation of the modern luxuries where we just cannot resist indulging on stuff like iphone, Sony laptop, Prata, LV. However it boiled down only to one word. Discipline ! If one had save up the money where he spent on his car loan every month , e.g. 800SGD and put it into a fixed deposit or unit thrust, he will gain much more in years to come. With the compounding effect of interest, a monthly saving of 400 for about 40 years would easily make you a millionaire.

Key number 2 – Acquire Property !

Having a property not only boost one self ego ( the feeling of owning something ), it also gives one a much stronger position when he would apply loans from the banks with very low interest rate, long loan repayment period and highest approved loan amount.

In a company scenario, with depreciation of the property and the interest paid up for the financing of the property being recorded on the balance sheet before tax profit. It can be effectively use to reduce the tax being imposed on the before tax profit figure and potentially save some money from the amount of tax paid.

Key number 3 – Be knowledgeable in your Financial Management.

Would you feel comfortable if someone told you, give me all your money in your bank and I give you a 50-50 chance to triple the amount in your bank balance. I don’t think I will because why would other people be interested managing our money since the money doesn’t belong to them in the first place. What they are concern is that they need your money to make investment, exposing OUR risk for a chance to POTENTIALLY make some profit and be able to reap some commission from it. Therefore, their mind set is to acquire as much customers as possible, thereby increase their GAMBLING chance and commission. You have to be the master to your own finance, else you just can’t control where your money would flow. It can well just flow out of your pocket and never get back.

While our grandparent’s time advocate saving is a virtue, our modern day philosophy is live for today and pay in the future. We only live once isn’t it ? Spent it since we wouldn’t know what would happen tomorrow.

As more and more people grew to believe the later to be true, we have inevitably made ourselves more vulnerable to become debt burdened.

I believe the highest interest rate for loan currently being charged the loan from credit card, where 24% p.a will be charged if card holder spent beyond his credit limit.

That is 2400 for every 10K spent beyond the credit limit. Is this amount spent necessary ?

Why not we prevent all this in the first place by spending within our limit ?

May be you blamed it to the temptation of the modern luxuries where we just cannot resist indulging on stuff like iphone, Sony laptop, Prata, LV. However it boiled down only to one word. Discipline ! If one had save up the money where he spent on his car loan every month , e.g. 800SGD and put it into a fixed deposit or unit thrust, he will gain much more in years to come. With the compounding effect of interest, a monthly saving of 400 for about 40 years would easily make you a millionaire.

Key number 2 – Acquire Property !

Having a property not only boost one self ego ( the feeling of owning something ), it also gives one a much stronger position when he would apply loans from the banks with very low interest rate, long loan repayment period and highest approved loan amount.

In a company scenario, with depreciation of the property and the interest paid up for the financing of the property being recorded on the balance sheet before tax profit. It can be effectively use to reduce the tax being imposed on the before tax profit figure and potentially save some money from the amount of tax paid.

Key number 3 – Be knowledgeable in your Financial Management.

Would you feel comfortable if someone told you, give me all your money in your bank and I give you a 50-50 chance to triple the amount in your bank balance. I don’t think I will because why would other people be interested managing our money since the money doesn’t belong to them in the first place. What they are concern is that they need your money to make investment, exposing OUR risk for a chance to POTENTIALLY make some profit and be able to reap some commission from it. Therefore, their mind set is to acquire as much customers as possible, thereby increase their GAMBLING chance and commission. You have to be the master to your own finance, else you just can’t control where your money would flow. It can well just flow out of your pocket and never get back.

Monday, December 28, 2009

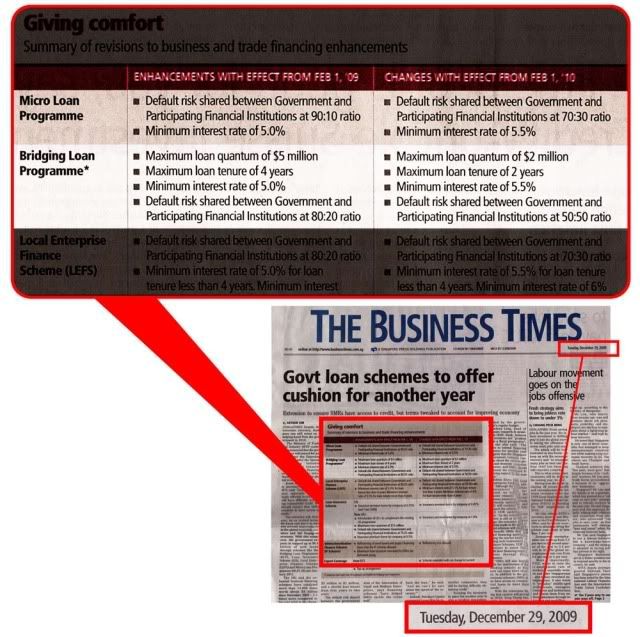

Revision to Spring Singapore Loan

From the Banker

Spring Singapore has made some revision to the current Micro/ Bridging loans.

Among the revision, there are 2 main points I felt business owner should really take note.

First, the loan tenor has changed from maximum of 4 years to 2 years, meaning monthly repayment will become MUCH higher, from about 2.7k per annum to about 7-8K per annum for a 100k Loan at 5% interest rate (effective).

The second important point to note is the rise in interest rate from 5% to 5.5%, meaning the cost of borrowing to the business owner becomes higher.

Therefore, if you are thinking about borrowing additional working capital for your business, it would be advisable to do it quickly before 1 Feb when the new policy take effect.

From the management of Your Boss Advisors

Spring Singapore has made some revision to the current Micro/ Bridging loans.

Among the revision, there are 2 main points I felt business owner should really take note.

First, the loan tenor has changed from maximum of 4 years to 2 years, meaning monthly repayment will become MUCH higher, from about 2.7k per annum to about 7-8K per annum for a 100k Loan at 5% interest rate (effective).

The second important point to note is the rise in interest rate from 5% to 5.5%, meaning the cost of borrowing to the business owner becomes higher.

Therefore, if you are thinking about borrowing additional working capital for your business, it would be advisable to do it quickly before 1 Feb when the new policy take effect.

From the management of Your Boss Advisors

Monday, December 21, 2009

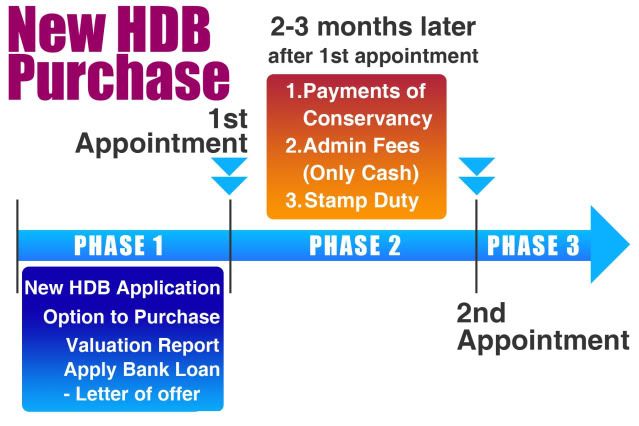

Purchasing your first HDB flat

From your property advisor

Purchase of New completed HDB flat

Many people have questions regarding the process of purchase of HDB flat.

Today I hope to be able to clear some doubts in your head by explaining how the normal process is going to look like.

Phase 1.

After paying a booking fee (option to purchase which is unfixed amount), you'll be submitting a housing application to HDB. (Cash payment)

Phase 2.

Then, roughly about 2-3 months, the HDB will make a second appointment with you to complete the transaction with you together with the stamp duty fees.

Phase 3.

Then, if you have brought your HDB house with a bank loan or CPF loan, this is the time you will be start paying your outstanding amount of money, owed to bank.

Simple.

Hope this helps

From the management of Your Boss Advisors

Purchase of New completed HDB flat

Many people have questions regarding the process of purchase of HDB flat.

Today I hope to be able to clear some doubts in your head by explaining how the normal process is going to look like.

Phase 1.

After paying a booking fee (option to purchase which is unfixed amount), you'll be submitting a housing application to HDB. (Cash payment)

Phase 2.

Then, roughly about 2-3 months, the HDB will make a second appointment with you to complete the transaction with you together with the stamp duty fees.

Phase 3.

Then, if you have brought your HDB house with a bank loan or CPF loan, this is the time you will be start paying your outstanding amount of money, owed to bank.

Simple.

Hope this helps

From the management of Your Boss Advisors

Saturday, December 19, 2009

A warm welcome to Your Boss Advisors

A very warm welcome to you, for visiting Your Boss Advisors.

We all know that bosses are a group of special people who are extremely resources and well equipped with insider knowledge across all field to ensure their success. We also know that they usually their own panel of advisors who could be friends or highly expensive professional, both existed to provide them ready advices to help them make the correct decision all the time.

Have you ever imagined you could be like them? Like your bosses? Yes you can! and that's why we created this blog in the hope to bridge the differences between a normal blue collar workers and their bosses, and allowing them to find out how can they improve themselves to one day become successful too.

From the management of Your Boss Advisor

We all know that bosses are a group of special people who are extremely resources and well equipped with insider knowledge across all field to ensure their success. We also know that they usually their own panel of advisors who could be friends or highly expensive professional, both existed to provide them ready advices to help them make the correct decision all the time.

Have you ever imagined you could be like them? Like your bosses? Yes you can! and that's why we created this blog in the hope to bridge the differences between a normal blue collar workers and their bosses, and allowing them to find out how can they improve themselves to one day become successful too.

From the management of Your Boss Advisor

Tuesday, October 20, 2009

Opening Bank Account for Business in Singapore

Words from the banker

The background story

Since the economic downturn around the world that started last year, banks around the world have tightened their internal compliance and regulation. Singapore is no exception. Most banks in Singapore the business's director and the authorized signatories' physical presence inorder to open an company account with the bank.

When you open an company account with the banks, most banks usually require you to maintain a minimum average balance monthly, else it will probably cost around SGD$15-50 usually if your bank account fall below the minimum average balance. The minimum average balance requirement at OCBC, DBS, UOB and Standard Chartered is $10,000 per month. OCBC has waived the minimum average balance requirement for the first 6 month to only SGD$500 inorder to woo more customers to open account with them.

For some foreign banks like HSBC and Citibank, the minimum average balance may be higher, ranging between SGD$25-50K.

The account opening procedures

The procedures and the requirements for opening an business account is similar across the banks where all bankers are required to do a extensive "KYC" ( Know your client) i.e customer due diligence before opening a bank account for any company, mandated by the MAS (Monetary Authority of Singapore).

A list of common questions that the banks are going to ask are;

1. Nature of business

2. brief description of supplier or target customers

3. Where does the source of fund coming from

4. rough estimate of annual turnover

5. Initial deposit amount

6. Size of the transactions

7. Details and background of Principal (director) and beneficiaries

8. Proof of beneficial ownership

9. M&A (Memorandum and Articles)

Approving Procedures

Upon the preparation of the necessary documents, approving procedures may required another internal review by the bank authority or another formal interview with the business owner and the company's directors. During this phase, the approving is really up to the discretion of the banks and they have every right to decline your application without revealing to you the reasons for their action.

This roughly summed up about the opening a company account with the banks.

Hope the above information will be useful to you to be use for reference.

The prices listed above are references from the official website of the respective banks and should not be treated as final. It would be advisable to check the latest rate with the respective banks itself.

From the management of Your Boss Advisors - Banker

The background story

Since the economic downturn around the world that started last year, banks around the world have tightened their internal compliance and regulation. Singapore is no exception. Most banks in Singapore the business's director and the authorized signatories' physical presence inorder to open an company account with the bank.

When you open an company account with the banks, most banks usually require you to maintain a minimum average balance monthly, else it will probably cost around SGD$15-50 usually if your bank account fall below the minimum average balance. The minimum average balance requirement at OCBC, DBS, UOB and Standard Chartered is $10,000 per month. OCBC has waived the minimum average balance requirement for the first 6 month to only SGD$500 inorder to woo more customers to open account with them.

For some foreign banks like HSBC and Citibank, the minimum average balance may be higher, ranging between SGD$25-50K.

The account opening procedures

The procedures and the requirements for opening an business account is similar across the banks where all bankers are required to do a extensive "KYC" ( Know your client) i.e customer due diligence before opening a bank account for any company, mandated by the MAS (Monetary Authority of Singapore).

A list of common questions that the banks are going to ask are;

1. Nature of business

2. brief description of supplier or target customers

3. Where does the source of fund coming from

4. rough estimate of annual turnover

5. Initial deposit amount

6. Size of the transactions

7. Details and background of Principal (director) and beneficiaries

8. Proof of beneficial ownership

9. M&A (Memorandum and Articles)

Approving Procedures

Upon the preparation of the necessary documents, approving procedures may required another internal review by the bank authority or another formal interview with the business owner and the company's directors. During this phase, the approving is really up to the discretion of the banks and they have every right to decline your application without revealing to you the reasons for their action.

This roughly summed up about the opening a company account with the banks.

Hope the above information will be useful to you to be use for reference.

The prices listed above are references from the official website of the respective banks and should not be treated as final. It would be advisable to check the latest rate with the respective banks itself.

From the management of Your Boss Advisors - Banker

Monday, October 19, 2009

Things to consider when applying for loans in Singapore

1. Your borrowing cost. i.e. the interest rate that you are paying for your loans.

A smart business man will take out a loan only if he thinks that he can fully utilize his loan to generate profit higher than the interest cost. e.g. his profit = 30%, his loan interest = 10%. Thus his net profit would be the 20% different he gained.

2. Do you have a good credit history.

Obviously, a person with good credit history will always able to get loan easier than a person with a bad credit history, because in the bank's perspective, a person with good credit history is has proven to be more likely to repay his loans.

There is this thing tagged onto everybody called credit bureau rating where one's number, type of loans and repayment history are being recorded. If you have not been repaying promptly, you will be black listed in the financial market, thus making you harder to get loan in the future.

Therefore, the next time your credit card bills come, make sure you repay on time to prevent getting blacklisted.

3. Know exactly what you are paying for.

Usually, there are processing fees or an annual fee that comes along with the loans provided by the banks. If you are to take up any loans, make sure that you are well aware of the money you are paying as it all adds up into your cost.

4. Is the interest rate going to stay throughout your loan tenor ?

Sometimes, there are certain type of loans which has their interest rate tagged to the market performance, having the interest rate going up or down depends on the economy. In addition, there are also loans which have their interest rate revised over a pre-agreed period of time. e.g. quarterly basis.

5. What is the loan tenor that you are comfortable with?

How many years you are going to commit yourself into the loan is a question that you have to really ask yourself. Shorter tenor usually comes with a cheaper interest rate as in the bank's perspective, the longer it takes you to repay your loan, the riskier the bank will be, thus charging you higher interest rate. However, shorter tenor also means that you will repay greater amount monthly and whether you overload yourself with a monthly repayment beyond your financial capabilities really depends on your own discretion.

6. What is the monthly payment you need to pay?

usually, your banker would tell you how much you are going to pay monthly depending on the tenor years you choose and the interest rate his bank is giving. Thus, make sure you explore the different tenor years to explore the differences in monthly payment before you consider taking up the loans.

7. The bank's reputation

We all know that different banks play out their competitive edge on different market segment or focus. For example, the local banks may be more interested on retail banking catering the needs for individual while the foreign banks are usually more interested to deal with business. Some banks may be known to provide better customer services, lowest interest rate or process loans faster than other banks. There, the word of wisdom is always to know who you are dealing with so to ensure you are receiving the best deals and the best services for yourself.

8. Do you need a term loan or an business overdraft.

Term loan means that you are paying a monthly installment based on your loan amount till you full repaid your loan according to the agreed loan tenor. Overdraft on the other hand is a credit facility which the bank will put aside for you, known to be your overdraft limit. Aside from probably the initial process fees or any annual fees, you are being charged only when you decide to utilize your limit. Overdraft facility works well for business who want to have ready credit as a form of insurance of your business when you are running low on your working capital due to money tied down else where or when bidding for projects, wanted to project an image where the company is financially well-equipped.

9. Do you or your company owned property?

If you are able to mortgage your property to the bank when you apply for your loan, usually you will be able to get a much lower rate than you trying to borrow without any collateral/assets for the banks.

Hope the above tips will aid you when you considering taking up bank loan in the future.

From the management of Your Boss Advisors.

A smart business man will take out a loan only if he thinks that he can fully utilize his loan to generate profit higher than the interest cost. e.g. his profit = 30%, his loan interest = 10%. Thus his net profit would be the 20% different he gained.

2. Do you have a good credit history.

Obviously, a person with good credit history will always able to get loan easier than a person with a bad credit history, because in the bank's perspective, a person with good credit history is has proven to be more likely to repay his loans.

There is this thing tagged onto everybody called credit bureau rating where one's number, type of loans and repayment history are being recorded. If you have not been repaying promptly, you will be black listed in the financial market, thus making you harder to get loan in the future.

Therefore, the next time your credit card bills come, make sure you repay on time to prevent getting blacklisted.

3. Know exactly what you are paying for.

Usually, there are processing fees or an annual fee that comes along with the loans provided by the banks. If you are to take up any loans, make sure that you are well aware of the money you are paying as it all adds up into your cost.

4. Is the interest rate going to stay throughout your loan tenor ?

Sometimes, there are certain type of loans which has their interest rate tagged to the market performance, having the interest rate going up or down depends on the economy. In addition, there are also loans which have their interest rate revised over a pre-agreed period of time. e.g. quarterly basis.

5. What is the loan tenor that you are comfortable with?

How many years you are going to commit yourself into the loan is a question that you have to really ask yourself. Shorter tenor usually comes with a cheaper interest rate as in the bank's perspective, the longer it takes you to repay your loan, the riskier the bank will be, thus charging you higher interest rate. However, shorter tenor also means that you will repay greater amount monthly and whether you overload yourself with a monthly repayment beyond your financial capabilities really depends on your own discretion.

6. What is the monthly payment you need to pay?

usually, your banker would tell you how much you are going to pay monthly depending on the tenor years you choose and the interest rate his bank is giving. Thus, make sure you explore the different tenor years to explore the differences in monthly payment before you consider taking up the loans.

7. The bank's reputation

We all know that different banks play out their competitive edge on different market segment or focus. For example, the local banks may be more interested on retail banking catering the needs for individual while the foreign banks are usually more interested to deal with business. Some banks may be known to provide better customer services, lowest interest rate or process loans faster than other banks. There, the word of wisdom is always to know who you are dealing with so to ensure you are receiving the best deals and the best services for yourself.

8. Do you need a term loan or an business overdraft.

Term loan means that you are paying a monthly installment based on your loan amount till you full repaid your loan according to the agreed loan tenor. Overdraft on the other hand is a credit facility which the bank will put aside for you, known to be your overdraft limit. Aside from probably the initial process fees or any annual fees, you are being charged only when you decide to utilize your limit. Overdraft facility works well for business who want to have ready credit as a form of insurance of your business when you are running low on your working capital due to money tied down else where or when bidding for projects, wanted to project an image where the company is financially well-equipped.

9. Do you or your company owned property?

If you are able to mortgage your property to the bank when you apply for your loan, usually you will be able to get a much lower rate than you trying to borrow without any collateral/assets for the banks.

Hope the above tips will aid you when you considering taking up bank loan in the future.

From the management of Your Boss Advisors.

Subscribe to:

Posts (Atom)